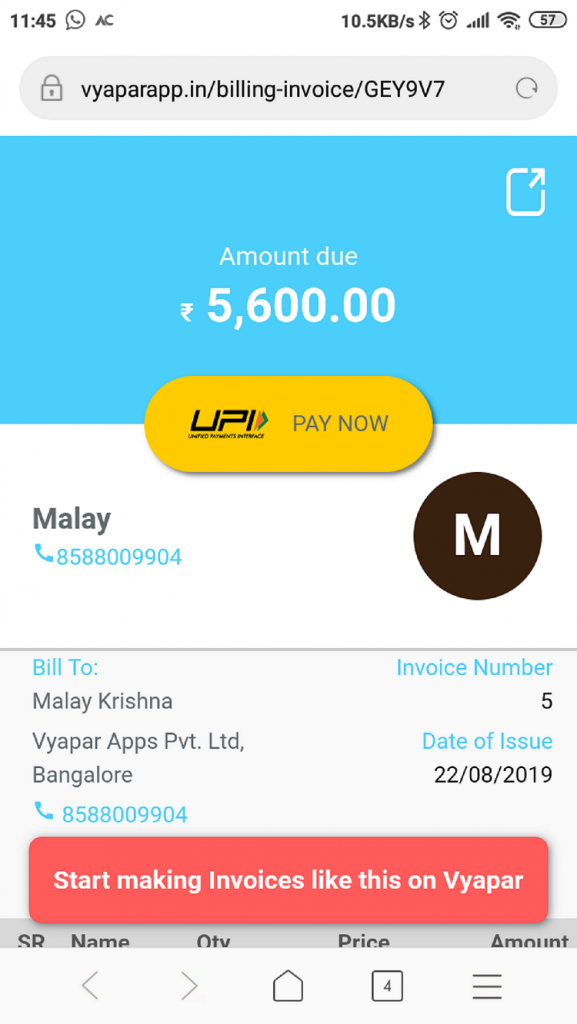

Vyapar, the simplified & free billing, inventory and GST software, enables UPI payments (Unified Payment Interface) to enjoy easy & hassle-free digital payments for its million customers. The strategic partnership shall allow merchants/users to pay digitally using UPI payment option through the Vyapar App.

UPI is a mobile payment mode that enables users to make instant money transfers directly between two bank accounts. Additionally, users can also make payments to merchants who accept UPI as a payment mode.

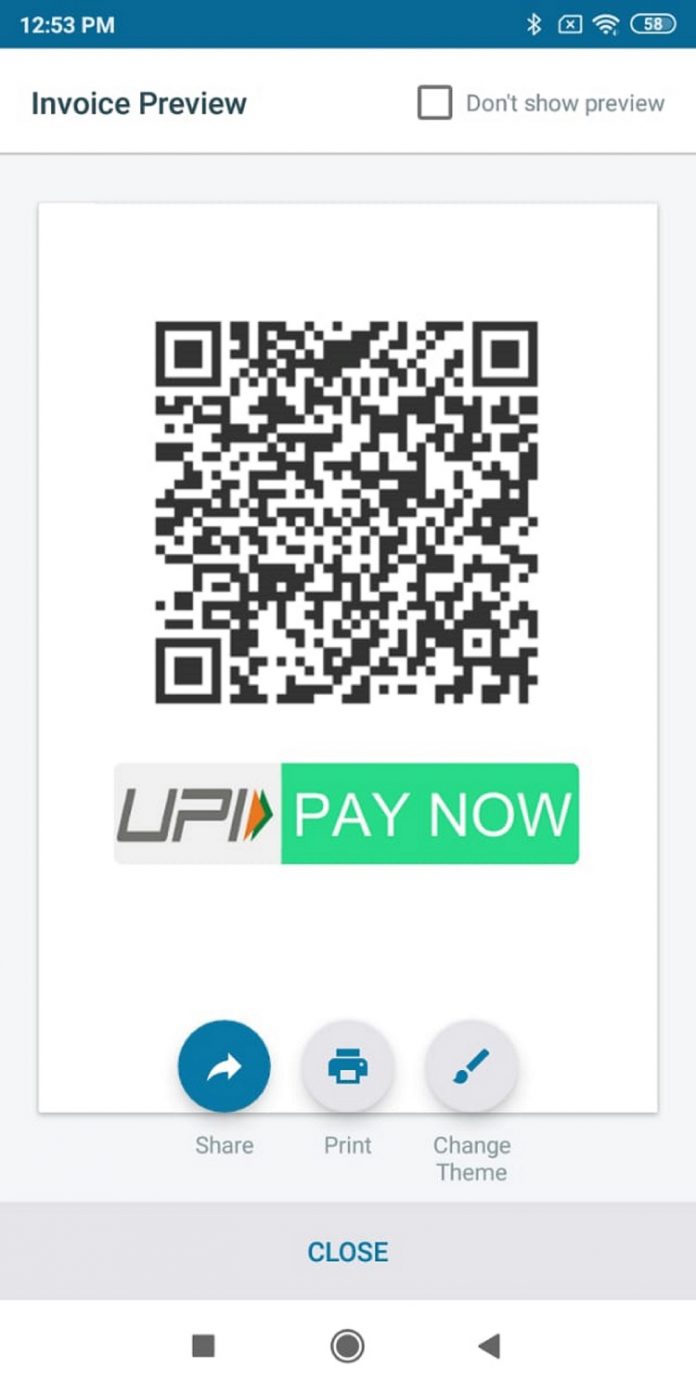

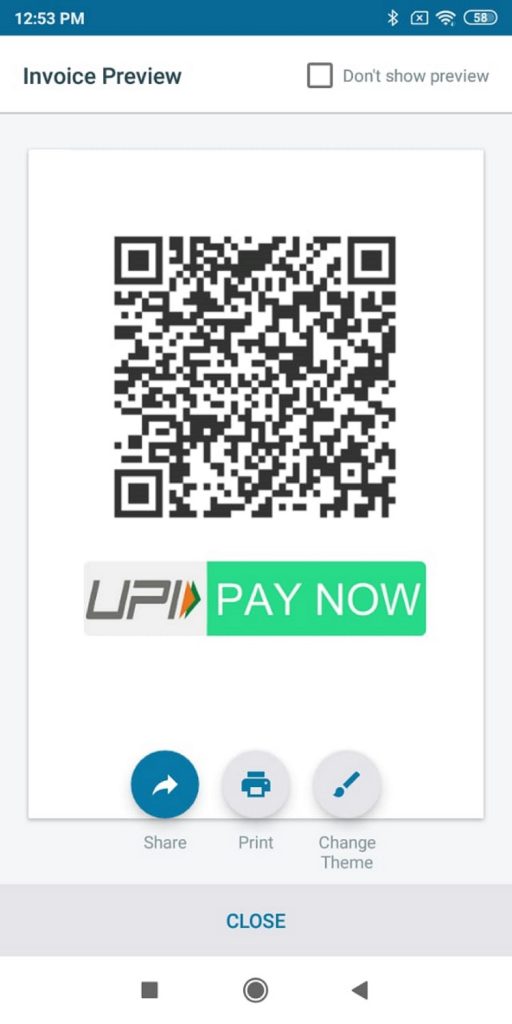

The feature will also allow users to make instant cashless payments directly from their savings bank accounts by scanning a merchant QR code through UPI Payment option. The new value-added feature shall benefit the million customers of Vyapar App, as they can now easily receive payments directly into their bank account, thereby reducing the lengthy procedures.

Speaking on the new feature to Vyapar App, Mr. Sumit Agarwal – CEO & Founder Vyapar said, “Vyapar has always focussed on building a strong platform for the customers, and adopt the newest tech trends and functionalities, balancing simplicity and security. We welcome UPI Payment to Vyapar platform. The strategic interface shall help us bring comfort and convenience to over a million customers/users of our App”

Vyapar, has enabled automatic transaction messaging for every merchant free of cost which helps merchants to keep their customers updated on each transaction. We also have plans to implement direct integration with banks and provide more payment options for merchants through other online payment channels.To enable seamless adoption, Vyapar shall also provide Online training to its customers, on creating UPI Account. Vyapar’s association with UPI will not only help widen its reach but also enhance its adoptability among Indian customers.