Bengaluru, Karnataka, India | 15th January 2021: The year of 2020 began with a series of uncertainties but soon businesses started to slowly stabilize, and some even grew back to pre-Covid levels. Every business across every sector took a severe hit, and the FinTech sector as well did not escape the pandemic. The first 30 days of the global crisis were the toughest, and Razorpay too witnessed a decline of 30% in digital payments. However, after the first 70 days of the national lockdown, digital payments rebounded by 23% indicating a slow but steady come back. Razorpay, the newest Unicorn on the block and the leading full-stack financial solutions company, launched the 7th Edition of The Era of Rising FinTech Report today.

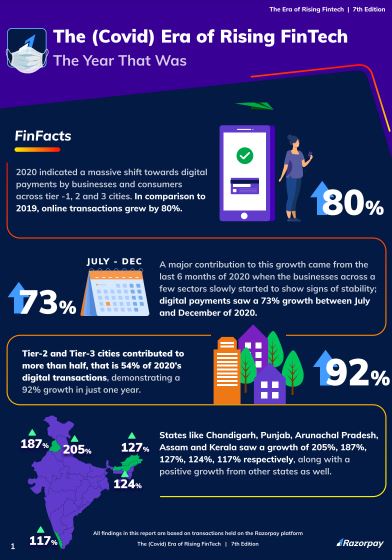

The 7th Edition of this report provides an in-depth study of an evolving FinTech ecosystem in this pandemic era. It analyses consumer behaviour and digital spending patterns during lockdown.It also provides comparative analysis of how different sectors and payment modes performed in the last year, 2020 as compared to 2019 when businesses and life were normal. In comparison with 2019, online transactions grew by 80% in 2020, suggesting a magnificent adoption of digital payments by consumers and businesses, alike.

Let’s take a look at a few more insights here. All findings in this report are based on transactions held on Razorpay platform between 2019 and 2020.

- A major contribution to the growth of digital payments in 2020 came from the last 6 months when businesses across a few sectors slowly started to show signs of recovery; digital payments saw a 73% growth between July and December as compared to the first 6 months of 2020.

- Tier-2 and Tier-3 cities contributed to more than half, 54% of 2020’s digital transactions, demonstrating a 92% growth in just one year.

- States like Chandigarh, Punjab, Arunachal Pradesh, Assam and Kerala saw a growth of 205%, 187%, 127%, 124%, 117% respectively, along with a positive growth from other states as well.

- Putting safety first, consumers across states opted to make all bill payments online giving the Utilities/Bill Payments sector a whooping 357% growth in 2020.

- Mutual Funds grew by 382% in a year indicating a ripe time for investments as consumers viewed the market corrections as an opportunity rather than a threat.

- Accounting and Employment agencies which form the Professional Services Sector were at the receiving end of this pandemic owing to cost-cutting by companies, creating a 66% decline. However, with the growth in Lending, Mutual Funds and Insurance, the Financial Services sector witnessed an extraordinary growth of 120%.

- Withevery service moving to virtual platforms, the Education, E-commerce and Healthcare sectors also witnessed a significant growth of 167%, 189% and 148% respectively. The Logistics sector also showed a slight growth of 18% in 2020.

- Every sector, except for Travel and Housing & Real Estate, has started to slowly grow back to pre-lockdown levels; these were the only two sectors that showed a negative growth during the last six months of 2020 when the situation started to ease out in parts.

- From consistently being the second most preferred payment method in 2019, UPI became the most preferred one in 2020, overtaking Cards, Netbanking & Wallets by showing a steep 120% growth. This is a sign of higher adoption of online payments especially from tier-2 and 3 cities.

- Wallets have regained attention in 2020 owing to the increased offers, cashbacksand an increase in the number of players in the market.

Harshil Mathur, CEO and Co-founder, Razorpay said, “In a year of unprecedented changes and challenges, 2020 also posed some interesting opportunities for businesses to embrace digital payments. Many moved their business online for the first time, ushering in a new digital transformation. While the overall transactions in 2020 significantly grew compared to the last year, what I’m really excited about is that it grew by about 73% in the last six months alone. This is a sign of the level at which both businesses and consumers have been adopting digital payments. So much so that the transactions from tier-2 and 3 cities grew by about 92% in a year – this is the first time that we’ve seen such a spectacular growth from these parts of the country. Contrary to how unprecedented the circumstances have been, the way I see it, it’s been a year of great innovation, new opportunities and the win of a much-awaited trust in digital payments. Businesses are beginning to stabilise and some of them are even back to pre-covid levels.”

He added, “With the ever-evolving demands from businesses and consumers, we have a long way to go, but, this, to me, is a great start. I’m looking forward to interesting trends picking up this year which will take our country many steps closer to the $5 Trillion Digital India dream.”

In the last six months, Razorpay has witnessed a 40-45% month-on-month growth. The company was recently crowned one of the leading FinTech Unicorns with a Series-D fundraise of $100 Mn. Razorpay currently powers payments for over 5 Mn businesses including the likes of Facebook, Airtel, BookMyShow, Ola, Zomato, Swiggy, Cred, ICICI Prudential among others and is all set to reach 10 Million businesses in 2021. A key area of growth for Razorpay in 2021 is Business Banking, and via its Neo-banking arm, RazorpayX, the company has been disbursing working capital of 250 Cr. per month and aims to increase it to 500 Cr. monthly in 2021.