All India ITR is India’s largest and most trusted website that offers online preparation and filing of Individual Income Tax Returns (ITR) pan India. All India ITR has been registered with the Income Tax department of the Government of India as an e-return intermediary.SSL encryption is used to ensure that information is highly secure.

All India ITR, ranked as the best online tax preparer, is recommended by top employers to their employees for compliance, and ease-of-use. All India ITR has the right mix of expertise in Finance and Information Technology, enabling it to deliver cutting-edge and innovative enhancements in its solutions. They provide all kinds of taxation services including ITR Filing, GST Compliances, TDS Filing, Company Registrations, Company compliances, License Registrations (Trademark, FSSAI), Import Export Code etc. All India ITR have more than 1 lakh satisfied customers with great customer reviews and feedback. All their service packages are very reasonably trimmed to meet needs and expectations.

Inception and Ideology

Established in March 2017, All India ITR is based out of Gurugram. Since then, All India ITR has grown to build the largest client base in this market phase.The primary objective of All India ITR is to make tax return filing easier with their filing system with the latest technology which has made it simpler and user-friendly. They are working to break the myth of tax return filing process that it is a time taking and tedious task.

They create awareness of the importance of filing ITR, the future benefits of it and how one can manage their finances for a secured future. All India ITR are trying to make ITR filing simpler. All users need to do is simply upload images of their documents and their team of tax experts will take care of the rest.

About the founder:

Mr. Vikas Dahiya, a business and technology enthusiast, founded All India ITR in 2017 after completing his Master’s Degree in International Business from the University of West London, United Kingdom. His objective was to create awareness on the importance of taxation and to simplify tax filing for citizens since the process can be quite confusing for first time taxpayers and for those who are not well aware of the filing process.

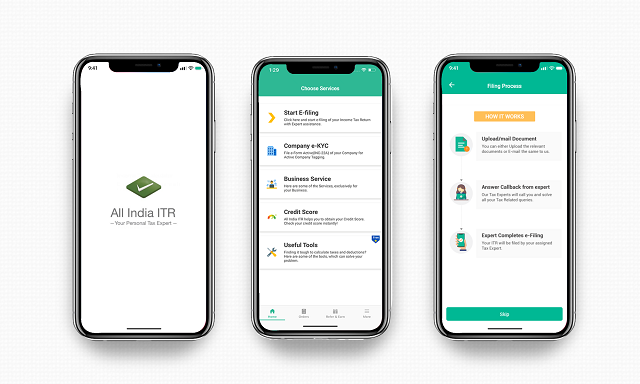

By bringing technology and taxation together, he has paved a way for the middle class to pay their taxes on the go. Through his firm’s online platform on Android and iOS mobile applications, his team at All India ITR works around the clock to break the myths around filing income tax return. A firm believer in education and awareness about taxation, he has made this process handy and accessible 24*7 for taxpayers where his team assists customers throughout the whole procedure and files the ITR for them. Through his mobile applications, Mr. Dahiya has done away with the hassle of documents and made ITR filing a 100% paperless process. Customers only need to upload pictures or PDFs of the documents where the system reads and auto-fills the forms.

After having brought ITR filing to a customer’s fingertips, Mr. Dahiya’s firm now caters to businesses well and has launched an array of business services across all their platforms including company compliances. With a team of 100+ tax experts, Vikas Dahiya is making headway into the digital world. His future plans for All India ITR include venturing into mutual funds and insurances.

With his quick wit and problem-solving skills, Mr. Vikas Dahiya has forged ahead and made a prominent place for his company in the world of taxation in a short span of time. He aspires to provide a quick and user-friendly tax filing experience to individual taxpayers as well as businesses. In his free time, Mr. Dahiya likes to catch up on the latest sitcoms. We are publishing an interview with Mr. Vikas:

Q. What is the problem you are trying to solve? Can you share with us any insight that led you to believe that this is a big enough problem?

Ans: As a country, India lags in financial literacy. And when it comes to filing a tax return, the general perception about tax filing is that people think filing ITR is a very tedious process. You will be surprised to know that in India, in fact, a very petite number of individuals actually pay taxes. According to 2017 data, out of 37 million Indians who filed ITR in 2016, a whopping 10 million were excused, leaving with just remaining 27 million actual taxpayers which are little more than 2% of the entire country. This is partly because there is less awareness about the filing procedure. Moreover, most of the people are still not aware of online platforms where they will get step-by-step guidance on filing the ITR in just a few minutes.

If we see at the macro-economy level, this issue is bigger than what it looks perpetually. An issue which we tackle on a daily basis and it’s a serious concern. There should be more awareness on the subject and the benefits of filing a tax return in time. Thanks to technology advancements along with smartphone penetration and Jio’s dominance, the tax return filing is simpler than ever now.

With our All India ITR.com platform, we are actually trying to build a habit of filing tax return conveniently. So that a large number of people may come under the ambit of taxpaying and the country yields the benefits.

Our platform is also suitable for people who are yet to make tax filing a habit. Especially millennial, you don’t have to specifically take out time to file the ITR; you can do it on the go from anywhere and anytime and moreover with All India ITR.com you can file ITR within just seven (7) minutes.

Q. Tell us about the Product / Solution. Explain how you went about the Product-Market Fit Process.

Ans: When we launched the platform in 2017, there were very few companies providing online tax return filing. Even though a few were existent, the filing processes were cumbersome. There was a clear need for platform like All India ITR.com. So we worked for a user-friendly, simpler process which is very understandable, affordable to meet the gap for a similar product in the market.

Q. What is your USP?

Ans: All India ITR.com has been registered with the Income Tax department of the Government of India as an e-return intermediary. SSL encryption is used to ensure that information is highly secure. We provide 24 * 7 support and tax filing by tax experts during the tax season.

A user only needs to upload images or PDFs of their documents on our platform. The system automatically reads them and fills the form for the user. Later on, the user can review the form and proceed to file ITR. We provide quick and hassle-free expert services with the aim to file ITR within 24 hours of receiving the order.

Our service subscriptions include expert advice sessions from tax experts to make one understand the taxation process better. We have team of experienced CAs and Company Secretaries.

All India ITR.com help reduces the tax liability and benefit the client by advising them to invest their money in various saving schemes for which they can claim deductions in their ITR. This not only saves their taxes but also provides them with a secure future by increasing their savings.

We assign a separate tax expert for each client that takes care of all the taxation requirements and provides assistance to the client.

Q. What were your assumptions when you entered the market?

Ans: There were not enough online platforms to provide simpler tax return process. When we commenced our journey, we tried to provide a simpler user-interface platform. To make it simpler, we introduced Chatbots, which was not available in any other platform at the time of our launch. We keep our self abreast with all the up gradation and amendments that take place time to time in tax return filing. Besides our web platform, we offer business services through our mobile applications as well. If we see in this space, no other company is providing business services from mobile applications. Through All India ITR.com, one can avail business services from both web and from mobile applications.

Q. Who is your customer?

Ans: Everyone is our customer. However, our portal is right fit for first-time taxpayers who are not much equipped with necessary information of filing online tax returns. The young lot find us the easiest as it takes shortest possible time on our mobile app to file the tax return. So, ideally, the first time taxpayers are our customer, but that being said, everyone who pays tax is our customer.

Q. What has been your biggest failure as an entrepreneur and what did you learn from it?

Ans: We can say there have been a few set-backs from where we learnt to do things in a better way. Mostly those were technology-based development hiccups. In the first year of All India ITR, we used to take feedback from our customers in knowing if the process was good enough to use or if there was any challenge they faced. Gaining insight from our customers, we enhanced our offerings and eventually sailed through. We continuously update ourselves with the changes for example a change in filing process or in the form itself, so accordingly we work to make it a smooth ride for our customers.

Q. What about the pricing?

Ans: We have kept it very affordable keeping in mind what our competitors are providing in the market.

Q. Is there any interesting success story? If yes, please write about it?

Ans: We launched All India ITR in 2017 and in the next ITR season which was 2018, we registered 1000% growth in our customer base.

Q. What is the big picture of your start-up? Is this product leading to something bigger? If so, how?

Ans: We are now aiming to capture larger market share in offering business services and company compliances. Initially we focused on the B2C market, then gradually we have shifted our focus to B2B services and we will go into investments segment as well. Right now, we have launched our company compliances and next we are thinking of coming out with investment consultations, insurances including mutual funds etc in due course of time.

Q. What is the insight that you have gained about this market, which no one else has? Uniqueness about your start-up.

Ans: We gain insights from our customers. As we take continuous feedback from them to improve and update our processes that stand us apart from the host of available platforms in the market today. Also, this keeps us ahead in knowing what our customers need actually and we continue adapt to that need. Additionally, our trend analysis gives us real time insights about what the customers would need and hence we do it as per the requirement. In this way, we actually preamp the bottlenecks!

Q. Who do you perceive as your competition?

Ans: ClearTax, H&R Block are the main competition but there are other players as well

Q. How do you differentiate yourself with them?

Ans: The vision of All India ITR is to spread awareness about taxation, to make it very simple and easy for our end users. For example, if you get a call from Income Tax Department or an email, normal people get scared of it. We want to make them aware that it’s not a thing to be scared rather its part of your income process, it’s a basically statement of your income. You are giving details to get it verified so you don’t have to be afraid. Rather you should be aware of what is going on in your financial. So, our vision is that, people from all walks of life should be aware of what is happening in their financials. They should be aware that filing ITR is not that difficult and the compliances as well are not difficult. So what happens is that in our process, when a particular tax expert is assigned to our client, he makes him understand how to use the deductions to get refund. This is how you can save more or this is where you should invest. Our taxpayers educate on how they can plan their financials so that income do not get deducted in the next financial year. We pay specific attention to each customer so that they understand the whole process themselves rather than just handing over some handouts to CA. We offer personalized attention to each of our customer and this is how we have achieved 1000% growth last year.

Q. What would be your goal to accomplish in the next six months?

Ans: For the next six months, we are focusing on B2B market and also we are coming up with the number one e-filing portal in India.

Q. What message do you want to convey to fellow entrepreneurs?

Ans: If you have a setback, a failure it shouldn’t stop you from what you want to do. Find a way to do it and move ahead with it. One shouldn’t be afraid of the obstacles that one finds in his/her way. Not loosing temperament while facing setback is another way to find success.

——————————

Thanks Vikas. Best wishes!

![How This Jaipur-Based Agritech Startup is Bridging the Gap with Innovative Farming Tools [ L to R ] - Shubham Bajaj and Rohit Bajaj, Co Founders - Balwaan Krishi](https://startupsuccessstories.in/wp-content/uploads/2024/10/L-to-R-Shubham-Bajaj-and-Rohit-Bajaj-Co-Founders-Balwaan-Krishi-218x150.jpeg)