India –August 6, 2019 – Zendesk, Inc. (NYSE: ZEN) today released new research with insights from more than 9,000 small and midsize companies globally. The report analyses the gaps between the companies’ perceptions of the customer experiences they deliver and the reality. While the results indicate the differences in the ability of small and midsize businesses to meet the growing expectations of customers, one discovery is consistent – fast growing companies are more likely to take an omnichannel approach, by offering a seamless and connected experience for communicating with customers across multiple channels.

SMB’s in India have witnessed a conducive environment in the last decade with tax exemptions and encouragement from the government. This has resulted in heightened growth in this segment while attracting large investments. Small and Mid-sized Businesses (SMB) are also key drivers of adoption of new age technologies such as Software-As-A-Service (SaaS) and Artificial Intelligence (AI) and as the Zendesk Benchmark report suggests this sector will be pivotal in driving transformation through Omnichannel.

Adds KT Prasad, Country Sales Director, Zendesk India, “Customers today spend more time online than ever before, with mobile penetration at an all time high in India. In order to keep up, small and mid-sized companies need to ensure that their customer support channels are integrated across online and offline channels. Fast growing companies are increasingly moving beyond legacy systems to embrace newer technologies. This allows them to be nimble and provide them with greater customisation for their customers.”

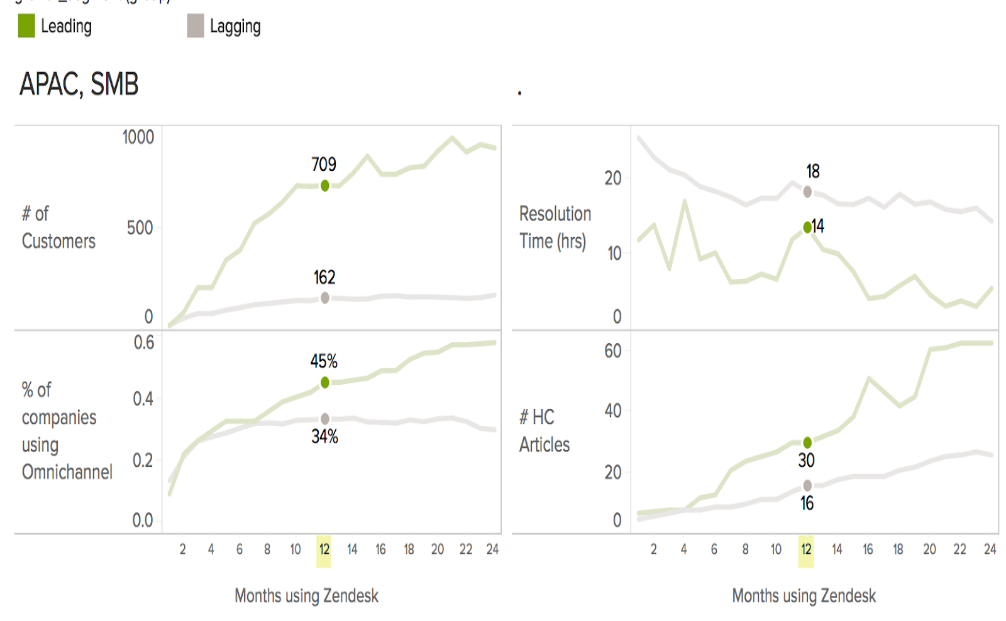

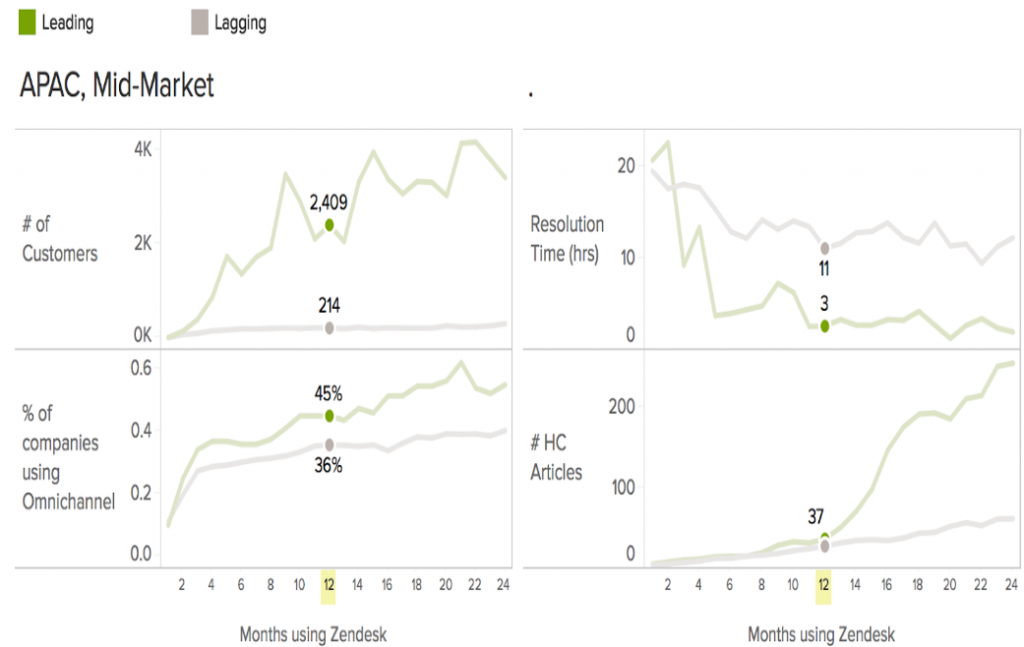

In an effort to unravel emerging trends in CX, Zendesk collected data from over 1100 small and midsize companies from India, Singapore, Australia and Japan. With innovation accelerating growth across industries, brands are looking for ways to improve their services. The study sample from companies using Zendesk in APAC for 12 months reveal that only 45 percent of the SMB group and midsize companies are truly omnichannel (Figure 1 and 2). This highlights the fact that many companies are failing to deliver on the customer experiences that they should be focussing on. However, it is observed that the SMB group is outpacing their peers with 11 percent of the fastest growing companies using omnichannel, while 9 percent of midsize companies having successfully adopted the omnichannel approach to improve customer service.

“Customers don’t think about a company’s size when they’re interacting with support. They expect to be able to reach out on the channel of their choice, and to get their issues resolved efficiently. This expectation applies to all businesses, both large and small,” said Ted Smith, head of market insights at Zendesk. “The recommendations in these reports can help small and mid-sized businesses understand what their fastest growing and most successful peers are doing to deliver the kind of customer experience every customer wants.”

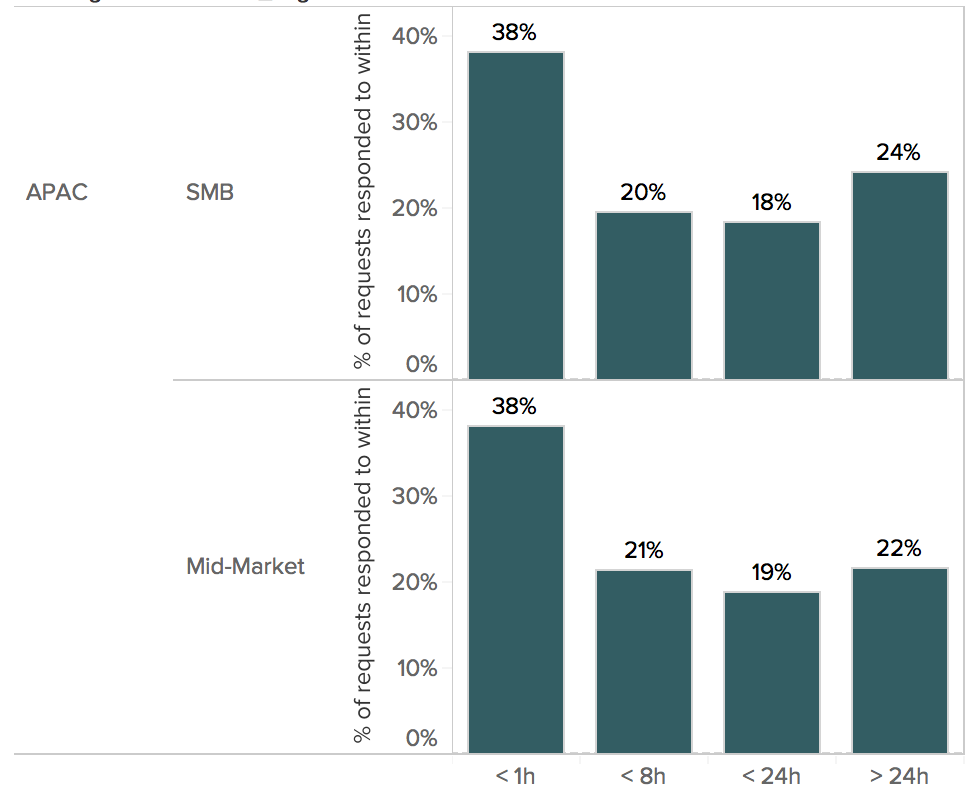

In terms of response time to address requests, the report found that both SMB’s and midsize companies in the APAC region using an omnichannel approach are able to address close to 60 percent of requests in less than the first 8 hours (Figure 3). Further, the study also uncovers that SMB’s respond to 76 percent and midsize companies respond to 78 percent of requests in less than 24 hours. This means that customers in these respective segments do not have to wait for long to get a response for their queries.

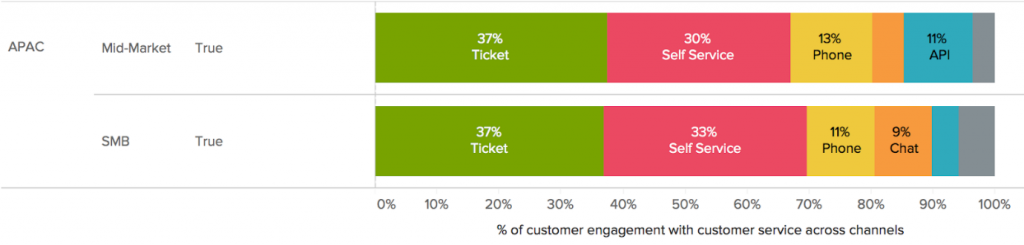

Another surprising finding is that more than 50 percent of leaders say offering self-service is important. However, in APAC only 30 percent of midsize teams and 33 percent of small businesses let customers find answers themselves (Figure 4). This means that fewer midsize businesses and small businesses utilize self-service capabilities to allow customers to easily address their own questions and save support agent resources for more complex requests.

The Zendesk Benchmark research and survey results also reveal a disconnect in the ability to understand customer data among small and midsize companies. Interestingly, many companies in APAC were found to be underutilizing apps and integrations to track key customer data. In fact, it was found that two-thirds of SMBs are not even collecting customer satisfaction scores. Such data such as social media engagements and customer surveys have the potential to give their respective support teams the much-needed insights to improve their overall customer experience.

For more information on the report, download the Five Biggest Gaps in Customer Service for Small Businesses and Midsize Companies.

Methodology

The Zendesk Benchmark is Zendesk’s index of product usage data from 45,000 companies using Zendesk across the globe. This report examines data from more than 9,000 small and midsize companies in the Zendesk Benchmark, as well as findings from surveys of customer service leaders in the US and the UK. It also incorporates insights from the Zendesk Customer Experience Trends Report 2019, the company’s annual look at the top trends in the customer experience space.