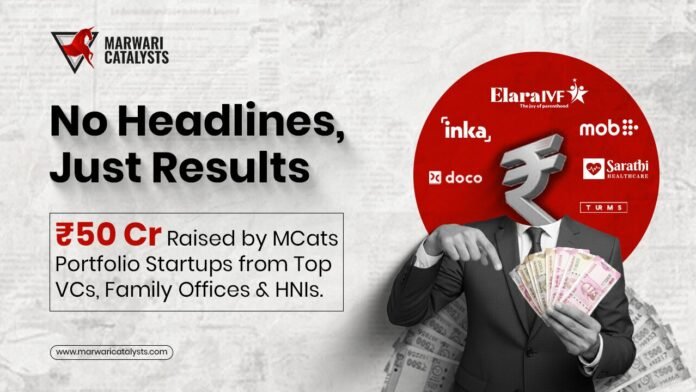

Jodhpur, Rajasthan, India | 25th November 2025: Marwari Catalysts (MCats), one of India’s fastest-growing accelerators and venture studios, has enabled a new wave of strategic investments across its portfolio companies. Startups backed by MCats have secured fresh funding from leading investors including SIG Tattva (Home to Hindware), GVFL, Antler, 35North, Vitalis Capital, IPV, and Malpani Venture — reinforcing strong confidence in MCats’ founder-first model.

With capital flowing into high-impact sectors such as healthcare, sustainability, AI, mobility, and consumer products, the development marks a positive shift for India’s emerging-market startup landscape.

Funding Momentum Across High-Impact Sectors

The latest round of investments spans multiple high-growth segments, each targeting critical challenges and opportunities across India’s Tier II and Tier III cities:

- Affordable Fertility Care (Elara IVF) – Delivering accessible, technology-enabled fertility solutions for aspirational non-metro markets.

- Fintech-Enabled B2B E-Commerce for Building Materials (Mad Over Building) – Streamlining procurement for construction and infrastructure players.

- Insurtech (Inka) – Using digital innovation to expand insurance access for underserved communities.

- Healthtech (Sarathi Healthcare) – Providing dignified, last-mile elderly care through assisted living and healthcare services.

- Consumer Brands (TURMS) – Smart apparel engineered with advanced fabric technology for comfort, durability, and performance.

- Mobility & Logistics (DOCO) – Solving transport inefficiencies and supply-chain gaps in non-metro regions.

More details on individual funding rounds will follow. The participation of angel investors, family offices, impact funds, and corporate innovation teams highlights strong cross-sector belief in the MCats model — especially as more HNIs and family offices explore the venture-studio approach.

Founder’s Insight

“This is not just capital — it’s validation,” said Sushil Sharma, Founder of Marwari Catalysts Group. “Our startups are solving real problems for the real India. Innovation doesn’t belong to any one geography, and these founders are proving that every day.”

A Sign of India’s Evolving Startup Ecosystem

The consolidated raise reflects a broader transformation in investor mindset. Rather than chasing inflated valuations in metro hubs, investors are increasingly backing sustainable, scalable ventures emerging from India’s heartland.

For MCats, this momentum reaffirms its mission: to bridge the gap between opportunity and origin by discovering, funding, and scaling high-potential founders in smaller cities.