National: 4th September, 2025: India stands at the threshold of its most ambitious tax reform since the Goods and Services Tax (GST) was first introduced in 2017. The 56th GST Council meeting on September 3, 2025, approved the transformative “Next Gen GST Reform” – better known as GST 2.0 – which will fundamentally reshape how Indians pay indirect taxes.

Starting September 22, 2025, this landmark reform introduces a streamlined two-slab structure, expands exemptions for essential goods, and promises significant administrative improvements. The overarching goal is ambitious yet clear: boost consumer spending, simplify business compliance, and accelerate India’s economic growth.

Why Reform Was Essential

Since 2017, India’s four-slab GST structure (5%, 12%, 18%, 28%) has drawn criticism from multiple quarters. Businesses complained about complexity and compliance burdens, while consumers faced high taxes on everyday necessities. The system created rate inversions, administrative bottlenecks, and particularly challenged micro, small, and medium enterprises (MSMEs).

The calls for change grew louder from industry bodies, consumer groups, and economic experts who argued for a simpler, more growth-oriented tax system.

GST 2.0 addresses these concerns with four core objectives:

- Simplification – Reduce administrative complexity for businesses and taxpayers

- Affordability – Lower costs for essential goods and services

- Compliance – Ease the regulatory burden, especially for smaller businesses

- Growth – Stimulate economic activity across all sectors

The New Tax Structure: From Four Slabs to Two

The most significant change is the consolidation of tax rates into a cleaner, more intuitive structure:

Current Structure (Effective September 22, 2025)

| Category | Previous Rates | New Rate | Coverage |

|---|---|---|---|

| Merit Goods | 5%, 12% | 5% | Essential items, basic necessities |

| Standard Goods | 18%, 28% | 18% | Most goods and services |

| Luxury/Sin Goods | 28% + Cess | 40% | High-end items, tobacco, alcohol |

Implementation begins September 22, 2025, coinciding with the start of Navratri festivities

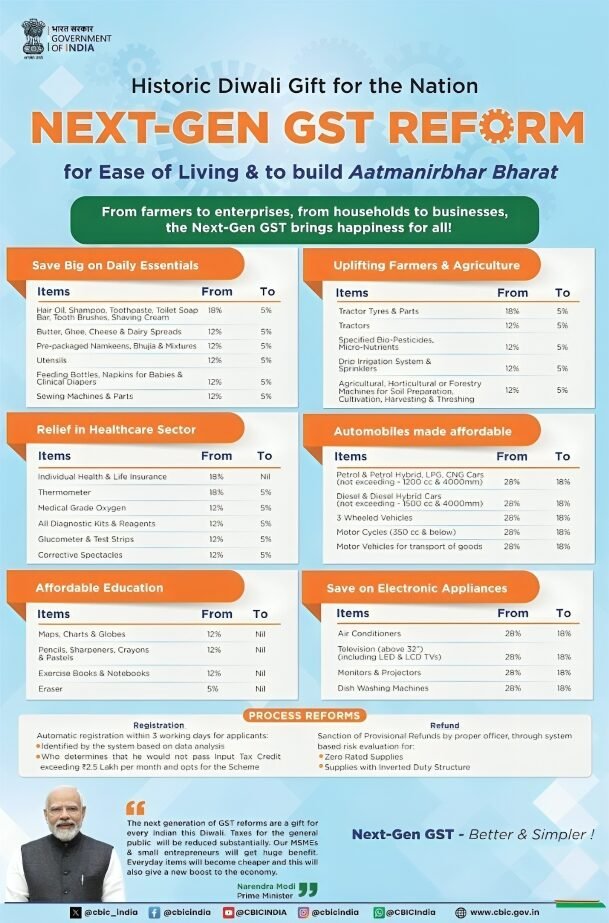

Winners: What Gets Cheaper

Household Essentials

Daily-use items experience significant price reductions as they move from higher slabs to the 5% rate:

- Personal care products (toothpaste, shampoo, hair oil)

- Food items (biscuits, processed foods)

- Basic consumer goods

Major Consumer Categories

Automobiles & Electronics

- Two-wheelers (up to 350cc): 28% → 18%

- Small cars: 28% → 18%

- Air conditioners and televisions: 28% → 18%

- Electric vehicles maintain preferential 5% rate

Healthcare Revolution

- Individual health insurance policies: GST-exempt

- Life insurance policies: GST-exempt

- 33 life-saving drugs: Zero-rated

- Enhanced affordability and coverage incentives

Construction & Infrastructure

- Cement: 28% → 18%

- Direct boost to real estate and infrastructure development

- Reduced input costs for construction sector

Zero-Rated Additions

- Paneer and Indian breads

- UHT milk (select categories)

- Essential fertilizers for agriculture

Economic Impact Analysis

Sectoral Benefits

Fast-Moving Consumer Goods (FMCG) Lower GST rates on everyday items are expected to drive higher demand and enable companies to reduce retail prices, creating a positive consumption cycle.

Automotive Industry More affordable vehicles should revive this crucial sector, with reduced GST making cars and two-wheelers accessible to broader income segments.

Healthcare & Insurance

GST exemption on health and life insurance policies will likely increase coverage penetration, supporting the government’s healthcare objectives.

Agriculture Lower input costs through reduced GST on fertilizers directly benefit farmers and support rural economic growth.

Fiscal Projections

Short-term Impact

- Estimated revenue loss: ₹48,000 crore for Centre and States combined

- Implementation period requires careful monitoring of revenue streams

Growth Dividend

Economic experts project that increased consumption and improved compliance could offset revenue losses while potentially adding 1-1.2 percentage points to GDP growth.

Administrative Modernization

Streamlined Dispute Resolution

- Regional Appellate Tribunals: Faster processing of GST appeals

- Reduced Legal Backlogs: Quicker resolution of tax disputes

- Standardized Procedures: More predictable outcomes for businesses

Digital Transformation

- Automated Registrations: Reduced processing time for new businesses

- Faster Refunds: Technology-enabled refund processing

- Simplified Returns: Streamlined filing procedures

- Enhanced Transparency: Better tracking and accountability

Industry Response

Positive Reception

Major industry associations including the Confederation of Indian Industry (CII) and Automotive Component Manufacturers Association (ACMA) have welcomed the reforms as a necessary rationalization that will:

- Reduce grey market activities

- Improve India’s manufacturing competitiveness

- Support formalization of the economy

- Enhance ease of doing business

Areas for Future Development

While broadly supportive, some stakeholders advocate for:

- Additional support measures for MSMEs

- Gradual inclusion of petroleum products under GST

- Further simplification of compliance procedures

Political and Strategic Context

GST 2.0 represents a significant policy initiative positioned as:

- Pro-middle class: Lower costs for everyday goods

- Pro-business: Reduced compliance burden and operational costs

- Pro-formalization: Incentives for businesses to join the formal economy

The reform aligns with broader economic objectives of boosting domestic consumption, supporting manufacturing, and maintaining India’s growth momentum in a challenging global environment.

Implementation Timeline and Future Roadmap

Immediate Changes (September 22, 2025)

- New tax rates take effect across most categories

- Special transition period for tobacco and sin goods to manage inventory

- Administrative systems updated for new structure

Medium-term Objectives

- Petroleum Integration: There is an intent to gradually include currently excluded items like petroleum products, with timelines to be discussed in future council meetings

- State Compensation: Continued support mechanisms as required

- Technology Enhancement: Further automation of tax processes

- Coverage Expansion: Bringing more economic activities under the GST net

Conclusion: A New Chapter in Tax Reform

GST 2.0 represents more than just rate rationalization – it’s a comprehensive reimagining of India’s indirect tax system. By simplifying the structure from four slabs to two, expanding exemptions for essentials, and modernizing administration, the reform addresses long-standing concerns while positioning India for sustained economic growth.

The success of these reforms will ultimately be measured not just in revenue collection, but in their ability to:

- Make essential goods more affordable for Indian families

- Reduce the compliance burden on businesses, especially MSMEs

- Stimulate economic activity across sectors

- Support India’s journey toward becoming a more formalized, tax-efficient economy

As implementation begins on September 22, 2025, the nation watches with anticipation to see how this bold reform translates into real-world benefits for consumers, businesses, and the broader Indian economy. The early months will be crucial in determining whether GST 2.0 delivers on its ambitious promises of simplification, affordability, and growth. Close monitoring and feedback mechanisms are in place to track outcomes and ensure the reforms achieve their intended objectives.